There’s an old saying that if you can’t beat ’em, join ’em. But in search, that saying is often turning into something different.

If you can’t beat ’em, buy ’em.

Acquisition search engine optimization is happening more often as companies acquire or merge, effectively taking over shelf space on search results. Why settle for having the top result on an important term when I can have the first and second result?

Should this trend continue you could find search results where only a handful of companies are represented on the first page. That undermines search diversity, one of the fundamentals of Google’s algorithm.

This type of ‘business crowding’ creates false choice and is vastly more dangerous than the purported dread brought on by a filter bubble.

Acquisition SEO

SEO stands for search engine optimization. Generally, that’s meant to convey the idea that you’re working on getting a site to be visible and rank well in search engines.

However, you might see diminishing returns when you’re near the top of the results in important query classes. Maybe the battle with a competitor for those top slots is so close that the effort to move the needle is essentially ROI negative.

In these instances, more and more often, the way to increase search engine traffic, and continue on a growth trajectory, is through an acquisition.

That’s not to say that Zillow or Trulia is doing anything wrong. But it brings up a lot of thorny questions.

Search Shelf Space

About seven years ago I had an opportunity to see acquisition SEO up close and personal. Caring.com acquired Gilbert Guide and suddenly we had two results on the first page for an important query class in the senior housing space.

It’s hard not to get Montgomery Burns at that point and look at how you can dominate search results by having two sites. All roads lead to Rome as they say.

I could even rationalize that the inventory provided on each platform was different. A venn diagram would show a substantial overlap but there was plenty of non-shaded areas.

But who wants to maintain two sets of inventory? That’s a lot of operational and technical overhead. Soon you figure out that it’s probably better to have one set of inventory and syndicate it across both sites. Cost reduction and efficiency are powerful business tenets.

At that point the sites are, essentially, the same. They offer the same content (the inventory of senior housing options) but with different wrappers. It idea was awesome but also made my stomach hurt.

(Please note that this is not how these two sites are configured today.)

Host Crowding

The funny thing is that if I’d tried to do this with a subdomain on Caring.com I’d have run afoul of something Google calls host crowding.

Matt Cutts wrote about this back in 2007 in a post about subdomains and subdirectories.

For several years Google has used something called “host crowding,” which means that Google will show up to two results from each hostname/subdomain of a domain name. That approach works very well to show 1-2 results from a subdomain, but we did hear complaints that for some types of searches (e.g. esoteric or long-tail searches), Google could return a search page with lots of results all from one domain. In the last few weeks we changed our algorithms to make that less likely to happen.

In essence, you shouldn’t be able to crowd out competitors on a search result through the use of multiple subdomains. Now, host crowding or clustering as it’s sometimes called has seen an ebb and flow over time.

In 2010 Google loosened host crowding constraints when a domain was included in the query.

For queries that indicate a strong user interest in a particular domain, like [exhibitions at amnh], we’ll now show more results from the relevant site.

At the time Google showed 7 from amnh.org. Today they show 9.

In 2012 they tweaked things again to improve diversity but that didn’t make much of a dent and Matt was again talking about changes to host clustering in 2013. I think a good deal of the feedback was around the domination of Yelp.

I know I was complaining. My test Yelp query is [haircut concord ca], which currently returns 6 results from Yelp. (It’s 8 if you add the ‘&filter=0’ parameter on the end of the URL.)

I still maintain that this is not useful and that it would be far better to show fewer results from Yelp and/or place many of those Yelp results as sitelinks under one canonical Yelp result.

But I digress.

Business Crowding

The problem here is that acquisition SEO doesn’t violate host crowding in the strict sense. The sites are on completely different domains. So a traditional host crowding algorithm wouldn’t group or cluster those sites together.

But make no mistake, the result is essentially the same. Except this time it’s not the same site. It’s the same business.

Business crowding is the advanced form of host crowding.

It can actually be worse since you could be getting the same content delivered from the same company under different domains.

The diversity of that result goes down and users probably don’t realize it.

Doorway Pages

When you think about it, business crowding essentially meets the definition of a doorway page.

Doorways are sites or pages created to rank highly for specific search queries. They are bad for users because they can lead to multiple similar pages in user search results, where each result ends up taking the user to essentially the same destination.

When participating in business crowding you do have similar pages in search results where the user is taken to the same content. It’s not the same destination but the net result is essentially the same. One of the examples cited lends more credence to this idea.

Having multiple domain names or pages targeted at specific regions or cities that funnel users to one page

In business crowding you certainly have multiple domain names but there’s no funnel necessary. The content is effectively the same on those multiple domains.

Business crowding doesn’t meet the letter of the doorway page guidelines but it seems to meet the spirt of them.

Where To Draw The Line?

This isn’t a cut and dry issue. There’s quite a bit of nuance involved if you were to address business crowding. Lets take my example above from Caring.

If the inventory of Caring and Gilbert Guide were never syndicated, would that exempt them from business crowding? If the inventories became very similar over time, would it still be okay?

In essence, if the other company is run independently, then perhaps you can continue to take up search shelf space.

But what prevents a company from doing this multiple times and owning 3, 4 or even 5 sites ranking on the first page for a search result? Even if they’re independently run, over time it will make it more difficult for others to disrupt that space since the incumbents have no real motivation to improve.

With so many properties they’re very happy with the status quo and are likely not too concerned with any one site’s position in search as long as the group of sites continues to squeeze out the competition.

Perhaps you could determine if the functionality and features of the sites was materially different. But that would be pretty darn difficult to do algorithmically.

Or is it simply time based? You get to have multiple domains and participate in business crowding for up to, say, one year after the acquistion. That would be relatively straight-forward but would have a tremendous impact on the mergers and acquisitions space.

If Zillow knew that they could only count on the traffic from Trulia for one year after the acquisition they probably wouldn’t have paid $3.5 billion (yes that’s a ‘b’) for Trulia. In fact, the deal might not have gotten done at all.

So when we start talking about addressing this problem it spills out of search and into finance pretty quickly.

What’s Good For The User?

At the end of the day Google wants to do what is best for the user. Some of this is altruistic. Trust me, if you talk to some of the folks on Google’s search quality team, they’re serious about this. But obviously if the user is happy then they return to Google and perform more searches that wind up padding Google’s profits.

Doing good by the user is doing good for the business.

My guess is that most users don’t realize that business crowding is taking place. They may pogostick from one site to the other and wind up satisfied, even if those sites are owned by the same company. In other words, search results with business crowding may wind up producing good long click and time to long click metrics.

It sounds like an environment ripe for a local maxima.

If business crowding were eliminated then users would see more options. While some of the metrics might deteriorate in the short-term would they improve long-term as new entrants in those verticals provided value and innovation?

There’s only one way to find out.

Vacation Rentals

One area where this is currently happening is within the vacation rentals space.

In this instance two companies (TripAdvisor and HomeAway) own the first six results across five domains. This happens relatively consistently in this vertical. (Please note that I do have a dog in this fight. Airbnb is a client.)

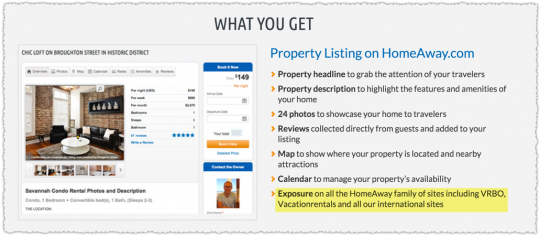

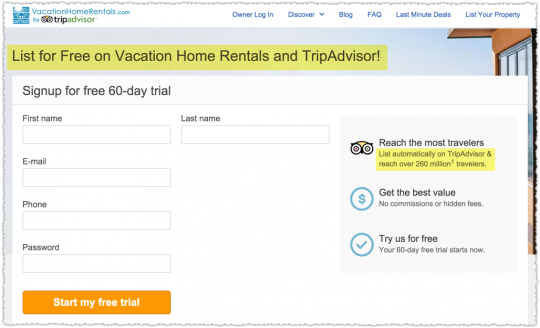

Are these sites materially different? Not really. HomeAway makes the syndication of your listing a selling point.

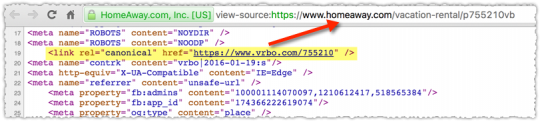

Not only that but if you look at individual listings on these sites you find that there are rel=canonicals in place.

In this instance the property listings on VacationRentals and HomeAway point to the one on VRBO.

The way the inventory is sorted on each of these sites is different but it doesn’t seem like the inventory itself is all that different at the end of the day.

TripAdvisor doesn’t do anything with canonicals but they do promote syndication as a feature.

A venn diagram of inventory between TripAdvisor properties would likely show a material overlap but with good portions unshaded. They seem to have a core set of inventory that is on all properties but aren’t as aggressive with full on syndication.

Let me be clear here. I don’t blame these companies for doing what they’re doing. It’s smart SEO and it’s winning within the confines of Google’s current webmaster guidelines.

My question is whether business crowding is something that should be addressed? What happens if this practice flourishes?

Is the false choice being offered to users ultimately detrimental to users and, by proxy, to Google?

The Mid-Life Crisis of Search Results

Search hasn’t been around for that long in the scheme of things. As the Internet evolved we saw empires rise and fall as new sites, companies and business models found success.

Maybe you remember Geocities or Gator or Lycos or AltaVista or Friendster. Now, none of these fall into the inventory based sites I’ve referenced above but I use them as proxies. When it comes to social, whether you’re on Facebook or Instragram or WhatsApp, one company is still in control there.

Successful companies today are able to simply buy competitors and upstarts to solidify their position. Look no further than online travel agencies where Expedia now owns both Travelocity and Orbitz.

The days in which successful sites could rise and fall – and I mean truly fall – seem to be behind us.

The question is whether search results should reflect and reinforce this fact or if it should instead continue to reflect diversity. It seems like search is at a crossroads of sorts as the businesses that populate results have matured.

Can It Be Addressed Algorithmically?

The next question that comes to mind is whether Google could actually do anything about business crowding. We know Google isn’t going to do anything manual in nature. They’d want to implement something that dealt with this from an algorithmic perspective.

I think there’s a fairly straight forward way Google could do this via the Knowledge Graph. Each business is an entity and it would be relatively easy to map the relationship between each site as a parent child relationship.

Some of this can be seen in the remnants of Freebase and their scrape of CrocTail, though the data probably needs more massaging. But it’s certainly possible to create and maintain these relationships within the Knowledge Graph.

Once done, you can attach a parent company to each site and apply the same sort of host crowding algorithm to business crowding. This doesn’t seem that farfetched.

But the reality of implementing this could have serious implications and draw the ire of a number of major corporations. And if users really don’t know that it’s all essentially the same content I’m not sure Google has the impetus to do anything about it.

Too Big To Fail (at Search)

Having made these acquisitions under the current guidelines, could Google effectively reduce business crowding without creating a financial meltdown for large corporate players.

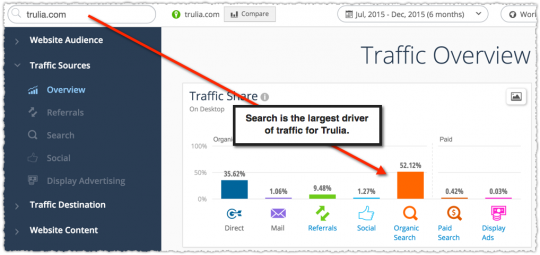

SimilarWeb shows that Trulia gets a little over half of its traffic from organic search. Any drastic change to that channel would be a material event for the parent company.

Others I’ve mentioned in this post are less dependent on organic search to certain degrees but a business crowding algorithm would certainly be a bitter pill to swallow for most.

Selfishly, I’d like to see business crowding addressed because it would help one of my clients, Airbnb, to some degree. They’d move up a spot or two and gain additional exposure and traffic.

But there’s a bigger picture here. False diversity is creeping into search. If you extrapolate this trend search results become little more than a corporate shell game.

On the other hand, addressing business crowding could dramatically change the way sites deal with competitors and how they approach mergers and acquisitions. I can’t predict how that would play out in the short or long-term.

What do you think? I’m genuinely interested in hearing your thoughts on this topic so please jump in with your comments.

The Next Post: Do 404 Errors Hurt SEO?

The Previous Post: That Time I Had Cancer

2 trackbacks/pingbacks

Comments About Acquisition SEO and Business Crowding

// 23 comments so far.

Nate Shiavr // January 20th 2016

Excellent post – and definitely a serious issue.

I think that Google in this case is simply acting as the messenger for a deeper economic issue. The world of corporate ownership is so convoluted and consolidated that I’m not sure where a single company could begin. Your examples are dead-on – with examples in every industry (I’m especially thinking of Disney).

In the medium and long-term, I think national governments will eventually have to step in to preserve competition (even then, I’m not sure how). And in that case, Google won’t necessarily be on the side of breaking up companies.

In the short-term, I think the Webmaster team could make improvements to force brands to truly add value outside of their domain & brand equity. Though I still don’t see them preserving business diversity if a holding company really did keep all their properties unique.

AJ Kohn // January 20th 2016

Thanks for the comment Nate. I’m glad I’m not alone at seeing this as a serious issue.

I’m certain there are examples in many industries. It’s tricky to address it, particularly since I don’t think users understand the landscape, which means Google doesn’t have a strong impetus to change. If users rose up and said, ‘we don’t like this’ Google would change, because they optimize for user satisfaction.

I should add that I don’t mind if a company owns sites that show up in associated results. You could own one site that ranked for one query class and then acquire another than is ranking well in another associated query class that you don’t perform well in.

Also, I’m not sure how you’d approach this with content based sites. Right now the US media landscape is owned by essentially 6 companies. But that actual content deployed is different across those properties. Mind you, it might be the same type of content but it’ll be different. And that hasn’t stopped upstarts like Netflix and Amazon from upsetting that applecart.

So again, there’s a lot of nuance involved and it’s hard to know where to draw the line.

Derek Gleason // January 20th 2016

Really great read. A couple of thoughts:

1. It’s a chicken-and-egg scenario, with greater inertia on both sides of brand building: Much harder to become a big brand via nonbranded organic search; much easier to maintain and expand the brand once you’ve arrived.

This seems to be a strong argument that, if you’re an upstart company, your early marketing strategies should rely less on organic search for growth, at least for product/service queries. There’s probably still more diversity in informational queries served through content marketing efforts.

2. As far as solutions go, I would love for Google to add a “small business” filter that used brand entity data to exclude websites of public corporations or privately held firms of a certain size. I can’t imagine this will ever happen, or is even feasible, but…

AJ Kohn // January 20th 2016

Thanks for the kind words and comment Derek.

I’ll be honest. I’m okay with brands ranking high. The reason being that it’s simply a reflection of user preference. When people stop shopping at Target and Walmart and buy from the local mom and pop then maybe we’ll see that reflected in search results.

Now obviously a lot of that has to do with marketing and advertising spend. But all of these brands started small and grew into the behemoths that they are. So I think many smaller ‘brands’ can do the same but it takes time and (marketing) money.

What I find unsettling is the same company crowding out potential other contenders by using this ‘business crowding’ approach. Because that’s not really about brand then, it’s about multiple brands that are really just … the same at the end of the day.

So a brand bias is something users are bringing to the table and is reflected back by Google in search results. But business bias is something companies are essentially manufacturing to presenting to largely unsuspecting users.

What I think is crucial to any start-up is to do good marketing and to think of brand equity as a real asset.

Derek Gleason // January 20th 2016

A critical distinction for sure, although I would argue that Google began favoring brands (because of legitimate offline consumer trust) before enough clicks rolled in to justify their Page 1 saturation on many SERPs.

As you note, people do love brands, and Google co-opted that affection as an effective proxy for website authority, which remains an elusive metric for its algorithm.

AJ Kohn // January 20th 2016

That’s an interesting question Derek. Did Google put their thumb on the scale before the clicks merited the position? Perhaps. Many of those big brands early on had horrible SEO. So the human raters were probably putting those sites way higher than the actual algorithm was based on traditional metrics.

I’m just unsure exactly how they’d go about putting that thumb on the scale algorithmically. Though I readily admit they’ve got engineers way smarter than me to figure that out.

Derek Gleason // January 20th 2016

A lot of people seem to trace that thumb-on-the-scale moment to the Vince Update in February 2009. (Not that that factoid is of much use.) Not long before then, however, Google CEO Eric Schmidt went on record saying, “Brands are the solution, not the problem. Brands are how you sort out the cesspool.”

Brands certainly seem to be a clever way for Google’s algorithm to ingest all the offline signals that would be relevant in search. We had an interesting experience not long ago when we updated a Wikipedia brand page following a company name change. It generated a huge lift as, presumably, it reconnected the website to the brand entity in Wikipedia. (I wrote about that here.)

I imagine the algorithm works similarly for other businesses.

AJ Kohn // January 20th 2016

I like that post Derek! That’s a clear indication (to me at least) that the Knowledge Graph, and entities, are quite powerful. When Google is confused about such things your site suffers. When you clean it up and make it simple for Google good things happen.

And Vince, yes, I had similar concerns when that was released.

Derek Gleason // January 20th 2016

Thanks, AJ. It was surprising that something as simple as updating an article title and URL in Wikipedia could have that kind of impact, and it may expose one piece of the puzzle for how Google pulls brand entity signals into search. (“If it’s earned a legitimate Wikipedia company page, it deserves some recognition in Google search.”)

As you note in your article on Vince, we’re left to wonder which other metrics—explicitly brand-focused or not—have caused the brand bump.

Jared // January 21st 2016

This was a fascinating piece of content. Thanks for sharing these examples.

I agree that there is much less diversity in SERPs than most people realize, and I also agree that it’s fundamentally bigger than Google. I’m actually not sure where I stand on the issue. Part of me thinks that if a company acquires another company, it is a strategic move, and they should have full liberty to “cash in” on those benefits. (I do sympathize with the smaller businesses though.)

In the case study with the vacation rentals (VRBO), I was a bit surprised to see all three ranking so well, especially with cross domain rel=canonical tags being used. Please correct my thinking if I am wrong, but I would assume that if a site is pointing towards another domain with rel=canonical tags, then the parent site (VRBO), should rank higher, and the other sites, should not rank nearly as well. I don’t think both sites should perform well as their should be a “transfer” of link juice. Props to their SEO team though for figuring that out. 🙂

AJ Kohn // January 21st 2016

Jared,

Thanks for your kind words and comment. The rel=canonical example is on the individual properties and not on the category results. It simply illustrates that the inventory is the same on those platforms.

And I understand the company perspective and applaud it in some degree. Yet, the user is really being short-changed and taken to its logical end those results get incredibly one-dimensional and stale.

Jon Openshaw // January 21st 2016

Love the post, AJ. Acquisition being the next necessary tool when conventional means start to falter really resonates with me, and it makes a lot of sense in terms of filling gaps or diversifying strategy. A definite in-road to international or areas of historically weak performance.

I guess I would ask one thing: if we are trying to add value to our own domain and still attempt to work within the parameters of giving users choice and abiding by the guidelines, could we not acquire a valuable domain and redirect it into our own as a way to hoover up the citations? Seems particularly salient in swinging anchor text distribution or diversifying.

Also, just in terms of Trulia & Zillow, it’s basically assured that their backlink acquisition efforts must be substantial. As such, is business crowding another instance of Big G turning a blind eye when larger business entities bend guidelines to just shy of breaking? It feels like a sort of legalese – “we’ve read the rules and we’re following them” – that isn’t wrong but still feels wrong. Ostensibly, neither Zillow nor Trulia are spending a lot on paid search according to SEMrush, but maybe there are other factors to consider like existing relationships for example? Just curious.

All the best! JO

AJ Kohn // January 21st 2016

Thanks for the comment and for bringing up something I didn’t cover in the piece.

I think it’s completely valid to purchase another site and redirect it to your current site, thereby boosting your own authority via domain diversity and potentially new anchor text variants. At that point you’re still working on gaining more visibility for one site. There’s no issue with users being presented with false choice since you’ll be collapsing two sites into one. You’re not playing the shelf space game and other sites and competitors are on a level playing field more or less.

Is Google turning a blind eye to it all? Tough to say. There’s one part of me that thinks Google must know this is going on and as long as users aren’t complaining and the user satisfaction metrics look good then they’re happy to sit on the sidelines.

But even a small look at what was in Freebase in terms of business relationships makes me think Google might not have that much visibility here. I’m not sure they’ve been giving much thought to this issue, particularly since there hasn’t been a lot of chatter about it. Consolidation has gotten a bit of press but rarely does it extend into how it impacts search.

However, wouldn’t paid search decline as a result of business crowding? If a company was getting three slots on high value search results do they need to augment their efforts with paid search? Upstarts could use paid search as a vehicle to crack results but shouldn’t Google prefer deep (consistent) pockets to shallow (out of business in 2 years) pockets? There seems to be a real motivation for Google to reduce business crowding when it comes to generating paid search revenue.

Now, search quality and paid search are completely separate at Google. But you have to think that if the topic were to gain more press that a conversation between the groups would take place to navigate the issue.

Frank Sandtmann // January 22nd 2016

Thank you for this interesting read, AJ. I appreciate very much this strategic approach to SEO matters. Most of the time we are caught up in operational skirmishes with hardly any time to look at the big picture.

I think it is valid to say that Internet related businesses tend to develop towards monopolies. In very many sectors it is “winner takes it all”. Through business crowding this can also be true for Google SERPs. Put on top, that Google itself in many countries is almost a monopolist, and it may result in relatively low interest to prevent such things from happening.

Would it be easy for Google to change it? Most probably yes, as their Knowledge Graph is extremely powerful, and further use of Machine Learning will only make it stronger. Thus I assume they will watch the development in important verticals, and start acting, when the perceived influence on user satisfaction is getting too negative.

AJ Kohn // January 22nd 2016

Thanks for your comment Frank. I agree that the key here is likely tied to user satisfaction in search results. The question is whether Google should be more proactive here rather than reactive. Should they wait until the grumbling reaches a dull roar or should they nip it in the bud.

Miguel Salcido // January 22nd 2016

AJ, let me just start out by saying that I’ve always admired your work. You are in my top 5 favorite online marketing blogs for sure.

While you admit that this post was partially started by the fact that you are competing against the people you are calling out in this post. I still don’t feel that was the right thing to do, ethically. Even if you stated that you have nothing against these companies.

I personally have no problem with this new term you are working to create, called Acquisition SEO. And I don’t have an issue with Business Crowding either. Let me explain why.

Let me start with Business Crowding. This is not, and should not, be an issue for me and everyone else because there are thousands if instances where search results produce the same ‘inventory’ from different domains. Any popular product or service that is distributed by many different companies will produce this experience.

I’m focusing on the main idea of your argument against Business Crowding, which was that somehow the user suffers if there is more than one site ranking on page 1 in Google, with the same inventory. And that’s just ludicrous because its commonplace for many products and services.

What if you don’t like the user experience that Zillow offers, and you prefer Trulia’s site, widgets, layout, colors, etc, etc.? You see, the difference is the user experience. Even if they have the same inventory and both rank on page 1, they both have different user experiences. There’s nothing wrong with that. You may prefer Zillow, and I may prefer Trulia. I would argue that having them both on page 1 in Google is a win for the user because of this.

Your other issue is with ‘Acquisition SEO’. My argument against that is based on the idea of value. SEO visibility has value. It is only right that in an acquisition the value of a site’s SEO visibility is accounted for. If someone wants to be $3 billion for that, then I consider that a win for SEO, because the SEO value was accounted for. It makes our jobs justifiable. I think that far too often the value of SEO is undermined by its uncertainty or just because of general ignorance to the ROI of SEO.

So Acquisition SEO is not bad because it crowds the results. You are still offering two different user experiences, even if you are offering the same inventory. Trulia and Zillow both had the same inventory before the acquisition. Would you have complained about Business Crowding then? No, you would not have. So what does it matter now that they are both owned by the same company? Has the user suddenly lost out because of this? No.

Is it bad for your client, Airbnb, that TripAdvisor and Home Away have the same inventory? Yes. Which is why I feel you are so upset over this and making an issue out of it. But its not bad for the user.

AJ Kohn // January 22nd 2016

Thanks for your comment Miguel. It’s nice to have someone disagree, even if I think you’re wrong.

First off, I have every right to say whatever I want about the topic (or any topic), particularly because I’m being transparent. I’m not hiding the fact that some of this comes from a place of self-interest. But that’s not the only reason the topic interests me and I’ve made it relatively clear that I think it’s a complex subject. So you’re free to not like this post or disagree but leave ethics out of it.

Now, lets move on to your points. The first is that the experience on each site should be enough of a differentiator despite the content being the same. Now, there’s a bit of truth to that because we do this quite often in marketing. If the features really are that different then I can see my way clear to having multiple sites. But is that really the case here? Is there something materially different in the UX?

Even when it comes to brand, you might buy wine from the vintner but then realize the same wine is sold for far less via Trader Joe’s under another label. Yet, when people find out they generally feel cheated. They’re just not finding out right now.

But lets think about this. Lets say you’re buying a house. Not online, the real deal. I have four identical houses and I put different furniture in them (which won’t be there afterwards) and paint them all a different color and give you those options for purchase. You wind up buying one of them instead of another house that you didn’t even get to see. It turns out that other house was probably the better deal. How do you feel now?

You selected the house among the choices that was best suited to your preferences (i.e – UX). But by not seeing truly different content you’ve actually narrowed the choice down to … 1.

You can argue that the user doesn’t feel like they’ve had their choice narrowed or that they’ll never know they didn’t have that other choice. But the fact that the user unknowingly participates in that system doesn’t mean it’s not bad for them.

Your second point is that the intrinsic value of SEO traffic that is baked into these deals validates our jobs. Well … I don’t need that to justify my job. That’s for sure. But would it really hurt SEOs if business crowding was addressed?

If sites had limited opportunity to do this then these deals wouldn’t happen nearly as much is my guess. Or they’d happen but with smaller price tags. If it’s the former, that means the SEO team for each competitor is sought out to help gain market share.

In the latter, at present once you acquire those sites the amount of additional SEO necessary to preserve that traffic is limited right? Or you consolidate your SEO team to manage multiple properties. On the flip side (i.e – less business crowding) if there were more room for more players on the first page you’d have more sites doing active SEO and there’d probably be more work out there for good SEOs.

Finally, I think you missed the time element mentioned in the piece. At the time of acquisition the sites are still different, but over time most companies look for efficiencies and they become more and more similar. It’s at that point that things become problematic.

But here’s a final thing to think about. How much time is wasted by users going from one site to the other to find the content they’re looking for? Maybe the UX is different but that just hides the fact that you’re looking at the same content. Do we feel good about that lost time as users fumble around only to wind up with the same result? Do we really think that’s a good thing? Does Google?

You can have any color you want as long as it’s black.

John Alexander // January 22nd 2016

Wow. A great post, and some very good discussion following. I share your concern, AJ, and appreciate your detailed response to Miguel; a lot of this concern is rooted in how we, as consumers, FEEL about our options and when we may FEEL cheated even though no information was actually hidden from us.

When it comes to identifying when and if acquisition SEO becomes a problem, I would add a layer to your point about the gradual consolidation of efforts and inventory. Let’s say that an imaginary vacation rental company (LodiVacations.com) focuses on a specific arena of rental properties. Maybe they’re great at connecting people with local activities. Then they purchase a competitor, StayInLodi.com, which has a great community of users that loves to leave reviews.

Now let’s say (and Miguel mentioned this specifically) that LodiVacations, Inc. decides that, while consolidating marketing efforts wherever possible, they want to retain the unique value of the 2 domains; keep promoting StayInLodi.com as a review-heavy site where new users can find in-depth content about specific properties, while continually finding new ways for LodiVacations.com to connect renters to fun things in the Lodi area.

Perhaps I’ve placed myself outside of your example at this point, but here’s my larger point. If the company shares inventory but maintains unique content and unique experiences, then finding both domains in SERPs seems optimal for users. That’s the payoff for LodiVacations, Inc’s time and effort spent generating unique content. I know where you stand on this, you’ve been clear about the importance of user satisfaction. But where the rubber hits the road is, doesn’t duplicate content have a lot to do with this? If Trulia and Zillow had the same things to say about the same properties, then having both rank would be sub-optimal for users; but that would be the same even if they weren’t the same company.

I understand that mine is a grossly simplified example, but I think that on-page content should be a larger determining factor than who owns that page. I hate the implications for smaller businesses, especially because most of my clients are small businesses, and I even prefer to patronize small local businesses when I can. But there are real advantages to being a wealthy company, and being able to generate content is one of them. That being said, do I expect these companies to maintain unique user experiences? Not really. Do I think that Acquisition SEO is something to keep an eye on? Absolutely.

Thank you, as always, for asking the big questions and sharing your insights.

AJ Kohn // January 22nd 2016

Thank you very much for the comment John. And yes, it’s absolutely about how the user feels, both in whether they don’t feel like they’ve been rooked even though they have and what might happen should they realize what’s going on.

But I really love your example here because it shows why this is such a complex problem. I generally feel like ‘features’ isn’t going to be a major difference when it comes to sites. But content as you describe here certainly could. If one was a very rich site full of guides and reviews with the listings integrated and the other was essentially a straight-forward ‘just the listings’ type of site then those are materially different.

In that case the content truly is different. The venn diagram would show enough unshaded at that point. In some ways I think this is what TripAdvisor has done. Whether that’s purposeful or not I can’t say.

But there are two things to think about here. First is whether a site is going to continue to commit to that type of content. I’m skeptical. Yet, perhaps they do and that would be awesome. The second part is where I think it gets more thorny.

If one of the sites is more listings focused and the other is more about the general area should they both be targeting the same query class? Wouldn’t one site target ‘Vacation Rentals in Lodi’ and the other ‘Things To Do In Lodi’ or something like that. And that would be totally fine and users would find the value in each when searching for that specific intent and each could cross-sell the other once users were on the site.

Now let me throw another wrinkle at you. What if you bought the site with all the great reviews and then you decided to simply split the reviews up between the sites? The reviews would be different on each but they’ll have essentially come from one source.

In that instance the specific content is different but the content type is essentially the same. That doesn’t particularly sound good at that point, at least to me. But you can see just how tough it would be to draw the line on this topic and the slippery slope here seems pretty steep.

Make no mistake, I’m uncomfortable with how business crowding might be addressed. It’s not black and white. However, I think I’m more uncomfortable with the idea that the practice itself might increase over time and what that might do to the search ecosystem.

David Gross // January 23rd 2016

Hi AJ – thanks for the post, I enjoyed it.

I’m going to go off at a totally different tangent here. As an entrepreneurial type who is into SEO, I think it’s quite cool that if you start an entrepreneurial venture and you aspire to create outstanding SEO strategies and you succeed – that ultimately this can deliver you additional exit value.

perhaps this trend is also reflective of a growing appreciation within financial markets for the long term barrier to entry and value of a great natural search platform.

AJ Kohn // January 23rd 2016

That’s an excellent point David. Whether you are troubled or not by business crowding it’s clear that as a start-up, if you crack these high volume searches you’re building additional value towards an exit.

The trick, for those acquiring these start-ups, is to look for those that aren’t too reliant on search. Between 50% and 60% would feel right to me after removing paid initiatives.

Nikolay Stoyanov // January 25th 2016

This article simply blew my mind. Even though I am an economic expert (at least when it comes to a formal education) I never thought about this phenomena. I will probably have to read it once again just so that I can compose all my thoughts and reevaluate all the questions I would like to ask myself. Meanwhile, let me ask you something. For example, if company had first 2 places on Google for a specific term, which out of 2 companies would it support? First result represents a better, more profitable company. But, the second company has more space to grow. In that regard, should they push the second and stall progress of first? Or vice versa? Again, crazy article! Thank you very much!

AJ Kohn // January 25th 2016

Thank you Nikolay. And you bring up an interesting question. If you did acquire a new company and you knew you wouldn’t have both ranking for that long (i.e. – a business crowding algorithm is in place), how would you proceed?

I think there are a tremendous number of factors at work including how mature the vertical is, the type of brand loyalty each site has garnered, which one is the more forward looking site etc. It wouldn’t be easy. I think the idea would be to find sites who are winning on query classes you aren’t, which is in some ways saying you should find sites that satisfy a slightly different intent.

Sorry, comments for this entry are closed at this time.

You can follow any responses to this entry via its RSS comments feed.