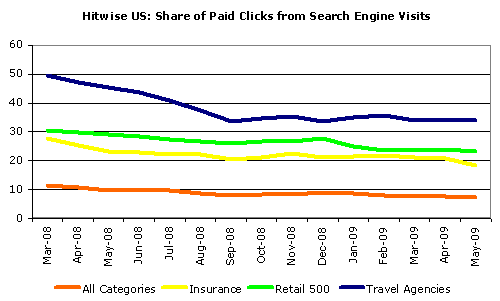

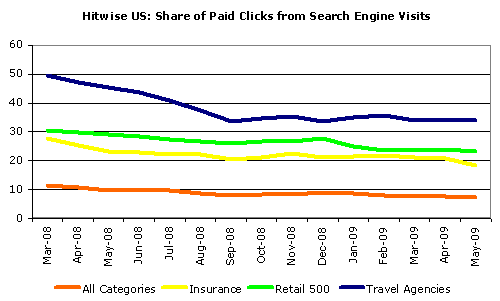

The latest from Hitwise and Comscore show that the growth in paid search is slowing.

In the four weeks to May 9, 2009, 7.25% of search engine traffic to All Categories of websites was from paid clicks. This compares to 9.84% in the same four week period in 2008 – representing a 26% decline in the share of paid clicks.

According to Comscore query volume grew 68% in the last two years while paid clicks grew only 18%. Now, lets be clear, paid clicks aren’t going down, they’re just not growing as fast.

There are a lot of theories about why paid search is sputtering. Here’s my analysis of five reasons behind the slow down.

Advertiser Decline

One theory is that the economy has forced many advertisers to abandon paid search. This is a compelling theory given the number of bankruptcies and marketing budget cuts.

Yet, nearly every survey (here, here and here) is showing that the economy has pushed more dollars online. And those online dollars were going to search – a medium giving advertisers far more control and, more importantly, providing a clear return on investment through analytics.

Search has become a near necessity these days and as the leader in search Google’s AdWords is a default part of many a marketing mix. Yet, the Google Tax has been going up.

The Google Tax? Anyone who has been advertising for more than three years can remember ten cent CPCs. CPC inflation was and still is a considerable problem. Yet we were all like frogs in a pot. The heat was turned up so slowly we didn’t really notice … until now.

Budget cutting forced companies to audit campaigns and what they found might have surprised them. The water was scalding hot!

Verdict: Probable.

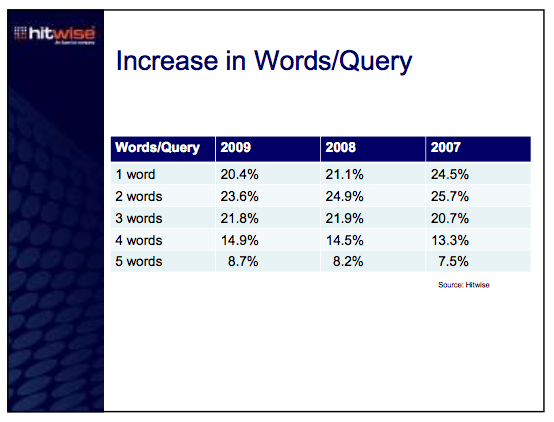

Words per Query Up

The number of words per query are up and continue to rise. Many surmise that the increase in query length is directly related to less advertising coverage and fewer paid clicks. This theory presupposes that most advertisers are running sophisticated campaigns on exact match and are heavily using negative keywords.

My experience is that sophisticated campaigns are still infrequent. Most have broad match and phrase match full bore. But, for the moment, lets say this is the case for larger advertisers. That leaves all of the other advertisers who are presented with an AdWords interface that encourages broad match.

Though there is some data that shows coverage is down, I’m unsure it is related to the number of words per query. The number of broad match and phrase match advertisers simply seems too great for query length – particularly of such a small magnitude – to have had an appreciable impact.

The graph is striking because of the scale. But it still amounts to a mere single digit percentage increase in words per query over two years.

Verdict: Unlikely.

Quality Score Suppression

Google has been using their Quality Score to ensure that relevant ads are presented for user queries. If Google determines your ad and landing page aren’t relevant you’ll be forced to pay more for the ad to be displayed.

The Quality Score isn’t always a reflection of reality. It is heavily influenced by the CPC your ad receives and overall account performance. Poor keyword research, account structure, copy writing and negative keywords could lead advertisers to pay more even though they have quality content.

Google’s implementation of Quality Score has weeded out poorly targeted ads. It has also increased the CPC for all advertisers. In this way, Quality Score may be contributing to the decline not through suppression but through making the Google Tax cost prohibitive.

Verdict: Possibly.

Better SEO

Search Engine Optimization (SEO) has improved. More and more sites have invested in SEO and have come to see it as a legitimate marketing strategy. ‘Why pay for it when you can get it for free?’ And that goes double when the economy hits the skids.

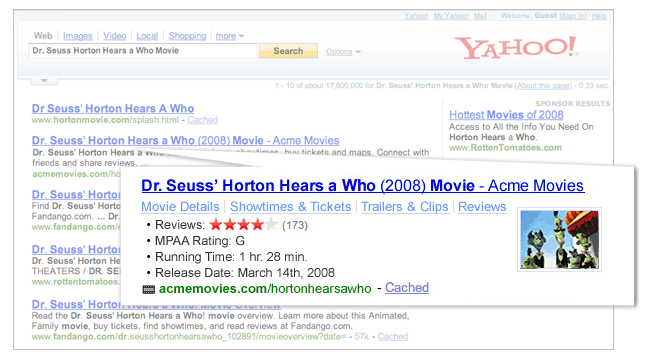

Search engines have also gotten better at SEO through algorithm tweaks and results presentation changes. From Yahoo’s SearchMonkey to Google’s Universal Search (local, video etc.), organic search results have become much more compelling.

What about Google’s Vince Change? The change to Google’s trust and authority algorithm resulted in top brands floating to the top of more search engine results. Could users be finding brands more often in organic search instead of clicking on branded ads?

Improving organic search has always been an odd balancing act for Google. Better search results improve retention and return rates. That means more ad impressions which should logically mean more paid clicks. But could organic search become too good and suppress paid clicks?

Verdict: Likely.

Mix-Shift of Queries

My own theory revolves around the mix of queries. What are people searching for and has that changed over time?

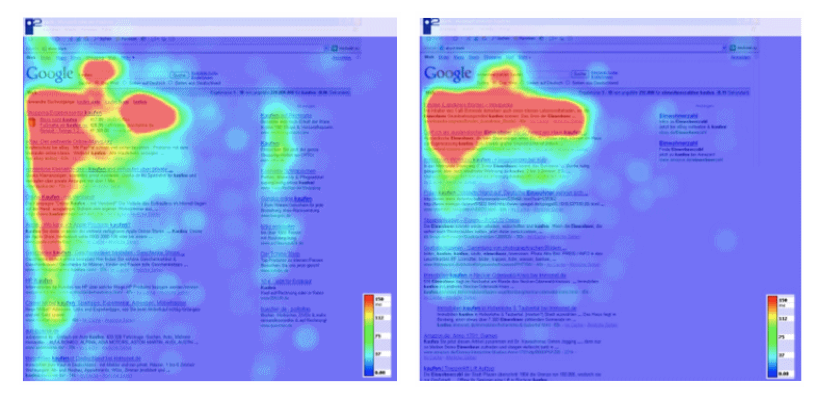

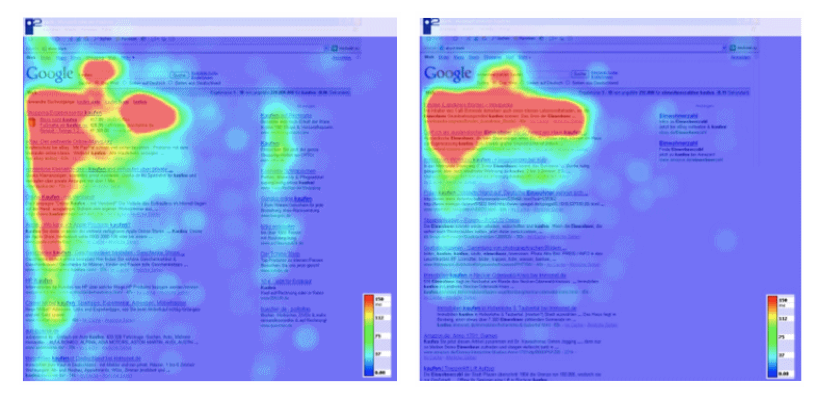

Look at the words per query graph again. What about those drops in December? Could commerce based queries be less diverse? We’ve already seen differences in transactional (left) versus informational (right) searches.

In tough economic times could the shift in searches be away from transactional or product searches? Instead, are people searching for information or (low cost) entertainment online? Those areas may have less advertising coverage than traditional product queries.

As CPM rates have declined and CPCs have increased the ability for content based sites to participate in paid search may have dwindled. The economics just don’t work out nearly as often as they used to.

Is this not also reflected in the Hitwise numbers? Travel, insurance and retail are getting fewer paid clicks. Travel in particular seems transparent. In a recession fewer people are taking vacations leading to fewer paid clicks. In addition, travel agencies may pull back on paid search as a result of decreased demand.

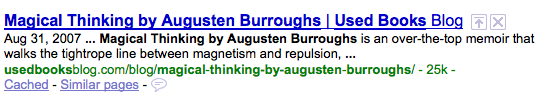

And what about search refinements. Earlier this year I wrote about a Yahoo! study on how users were refining their queries.

Could users be refining their queries more frequently with a greater understanding that refinement will lead to better results? If so, I’d hazard that refined queries likely have a lesser chance of garnering a paid click. These users are highly focused on the organic results to determine if their refinement was successful. This dovetails nicely with the informational search eye tracking study above.

Verdict: Probable.

Hodge Podge

In the end I’d bet it’s a little bit of everything mentioned with a dash of the unknown thrown in for good measure.

How, why and what people search coupled with the failing economy and an online advertising model in flux is going to have an impact on paid search.

Search, as a business, is still rather young. We’re all trying to learn what makes it tick and how it’s going to grow in the future.

This is what draws me to online marketing and search specifically. The answers aren’t black and white and the territory is uncharted.

And with that, what are your thoughts? What do you think of my analysis? Why do you think paid search growth is declining?